John Zito, Co-President of Apollo Global Management – which boasts $840 billion of assets under management – posed a question last fall that seems to have grabbed Wall Street by the neck this week.

Speaking at a Toronto gathering in October, Zito told investors the biggest risk was not tariffs, inflation, or a long stretch of elevated interest rates. He put it more bluntly:

“The real risk is – is software dead?”

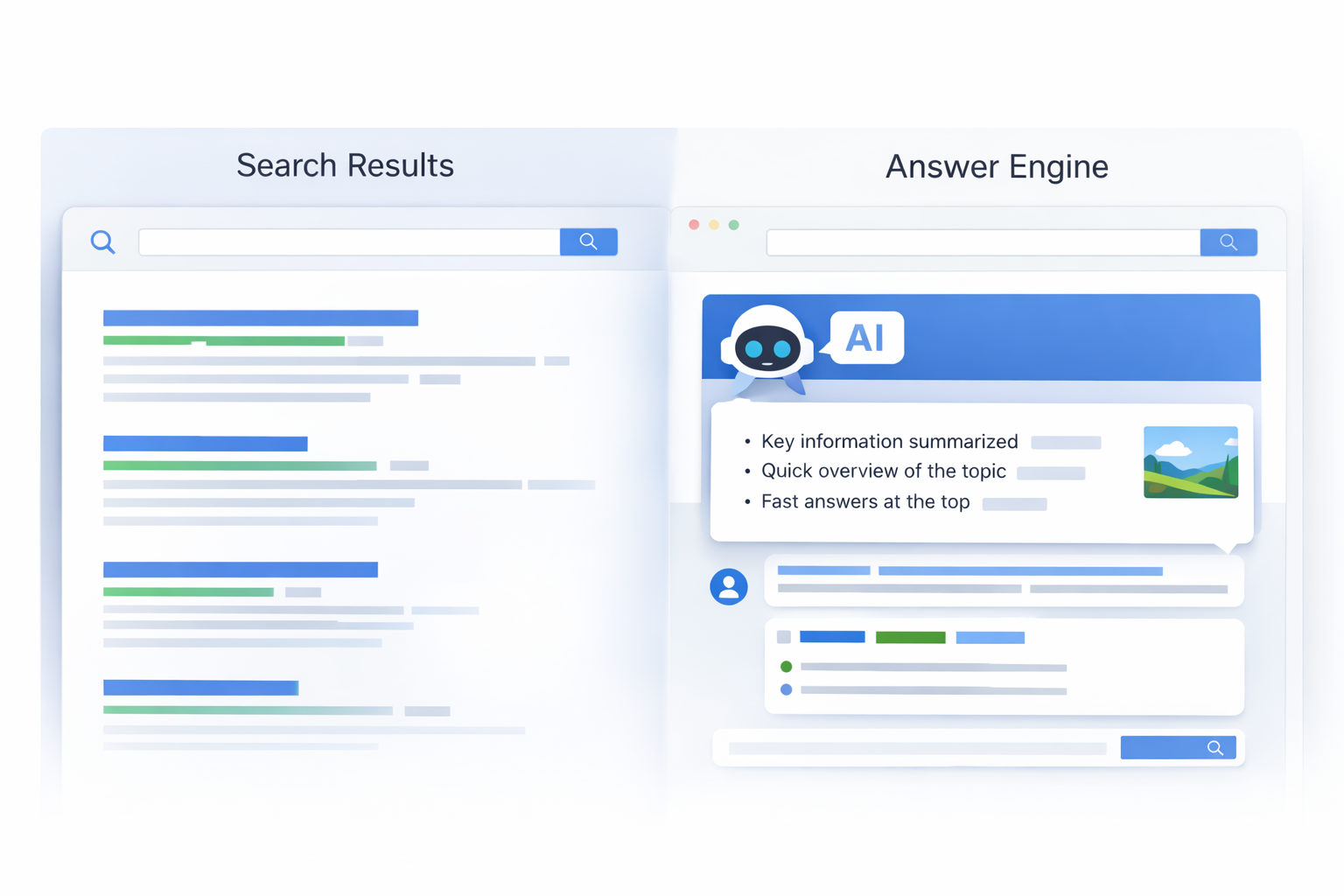

It’s a jarring line, but it’s also a useful one. Not because the software business is dead, of course, but because the line captures the fear that suddenly ran through the markets this week: AI is no longer being priced as just a feature that lifts software. AI is being priced as a force that could weaken software’s pricing power.

And, to borrow from Sergei Prokofiev's Peter and the Wolf: “What then, Peter?”

This week, Wall Street offered an answer.

What the market did this week

The market fell because investors started rethinking a whole set of assumptions about tech and software at the same time.

On Thursday, the S&P 500 fell about 1.2%, and the Nasdaq dropped about 1.6%.

Software took it on the chin. The iShares Expanded Tech-Software ETF, which is a decent shorthand for “public software,” finished down about 5%.

One of the week’s loudest moments came from Amazon. The stock closed down about 4.6% Thursday. The news hook: Amazon is signaling a massive new investment cycle tied to AI infrastructure. The company is planning $200 billion in 2026 capital spending, and investors recoiled at the scale and timing.

Put those together and you get the mood: the AI era is arriving with both promise and peril. (Yes, we have blue sky thinking and blue ocean strategies, but someone is going to have to pay some pretty outrageous bills.)

Even Nvidia got pulled into it

One reason this week was different from most is that the selling pressure did not spare what we might call "the obvious AI winners.”

Nvidia closed Thursday around $172 a share, down over 10% just in the past five trading days. In other words, a company that has come to symbolize the AI boom still moved like a stock that the market was trying to de-risk.

And that's the point: When the crowd gets nervous, it doesn't just sell the questionable names, it often sells the whole category. (Or to use the technical term, "the whole kit and caboodle.")

Why the selloff hit software especially hard

The market’s software story for years has been simple: recurring revenue, sticky customers, and high margins.

This week, that story got questioned from two angles at once.

First, AI is costly to build. Investors are staring at huge spending plans across the hyperscalers and asking how quickly those bets turn into durable profits.

Second, AI might be a substitute, and not just an upgrade. Reuters described mounting fears that rapidly improving AI could disrupt software and data services, the kinds of businesses investors used to treat as safe compounding machines.

That's why Zito’s line suddenly sounds less like an attention-getting stunt and more like a market mood board. Reuters estimated roughly $1 trillion has been erased from U.S. software and data services stocks since Jan. 28, with the group sliding for seven straight sessions.

Jensen Huang called the selloff “illogical.” I’m not so sure.

As software stocks sank, Nvidia CEO Jensen Huang pushed back hard. Bloomberg quoted him calling the move “the most illogical thing in the world,” arguing that software products are tools, and AI will use those tools, not reinvent them. He reached for a screwdriver analogy: "Would you use a screwdriver, or invent a new one?"

At a conceptual level, that's fine. Software does not disappear. (At least, not overnight.)

But it also sidesteps what investors were actually selling this week. The market was not declaring the end of software. It was repricing something narrower and more painful: software margins and pricing power in a world where AI features get bundled, copied, or commoditized faster than many incumbents expected.

The Big Picture takeaway

Zito’s quote is provocative, but the real question underneath it is more specific:

In a world where AI is everywhere, which software companies will get to keep charging premium prices...and which ones won't?

A rally next week wouldn’t change the underlying story. Markets can rebound quickly; business models don’t. The question beneath the selloff is whether AI becomes a new profit engine for software, or a slow squeeze on the margins that made software look safe for so long.

That’s why “Is software dead?” lands as more than an attention-getting line. No, software isn’t dead. But “software as we’ve priced it” may be – and we’re only at the beginning of figuring out who gets to keep charging premium prices in an AI-first economy.