Enterprise AI has crossed an important line. What began as pilot projects has now become part of everyday work, with leaders tracking outcomes and moving budgets accordingly. The third annual Wharton–GBK 2025 AI Adoption Report – a 90-page effort released this week by Wharton Human-AI Research and GBK Collective – offers a detailed snapshot of where adoption stands in the enterprise in 2025.

This year’s report surveyed 800 U.S. enterprise decision-makers at companies with at least 1,000 employees and more than $50 million in annual revenue. The survey was conducted this summer and focuses on usage and perceptions, investment and ROI, in addition to people-and-process factors such as leadership, skills, and training.

Read as a time series in the rollout of AI – 2023's exploration, 2024's experimentation, and 2025's theme of “accountable acceleration” – this year's report outlines a two- to three-year path from adoption to durable ROI, a path that's built on clear playbooks, firm guardrails, and tight integration with existing systems so that improvements become standard practice.

This "20 Takeaways" special report examines the findings and highlights some of the most significant findings, including how leadership and policy are evolving, in which projects many companies have found the most reliable value, and where AI agents are most likely to be found in the enterprise.

20 takeaways from the report

1) AI has moved into everyday work.

Enterprise adoption has crossed from experimentation into habit: 82% of decision-makers report at least weekly use (up 10 points year over year), and 46% say it is part of daily routines (up 17 points). The report calls this “accountable acceleration,” meaning that usage favors outcomes over novelty. Functions with repeatable knowledge work – IT, procurement, and finance – are often out in front because it is easier to standardize tasks and measure gains.

2) ROI tracking is standard – and the results are mostly positive.

Seventy-two percent of organizations now measure GenAI ROI, with productivity and incremental profit as the primary metrics. About three in four leaders already report positive returns, suggesting that AI is paying its way even as programs scale. Tracking itself is the cultural signal: It moves conversations from “cool demos” to “what changed in throughput, quality, or margin.”

3) Leaders see a two- to three-year payoff window.

Most decision-makers expect meaningful returns on that timeframe, which places a likely inflection around 2026. That horizon reflects more than optimism: Playbooks, guardrails, and integration work described throughout the report are now in place in many firms. With foundations laid, the next returns come from wiring AI deeper into core workflows and letting measured gains compound.

4) Budgets are rising in the near term – and beyond.

Eighty-eight percent of respondents expect larger AI budgets over the next 12 months, and 62% foresee increases above 10%. The functions most likely to see bigger allocations include Operations, IT, Finance and Accounting, and Product and Engineering – places where process change can be tracked and scaled. Multi-year projections also point to continued expansion, aligned with building internal capability and governance.

5) The spending levels are real.

Nearly two-thirds of enterprises report annual AI budgets of $5 million or more; among Tier 1 firms - those with annual revenue of more than $2 billion - almost a quarter of AI budgets already exceed $20 million. Tier 2 organizations ($250 million to $2 billion) and Tier 3 organizations ($50 million to $250 million) are stretching smaller budgets by aiming dollars at high-frequency, measurable workflows.

6) Where dollars go: technology and in-house R&D.

New AI tools and platforms (21%) and investments into existing systems (17%) together account for more than a third of 2025 technology budgets. Internal R&D averages 17% overall – and IT leaders say roughly a third of tech budgets specifically is now directed to in-house development. The pattern is clear: Off-the-shelf tools are paired with bespoke components that fit a company’s data, risks, and workflows.

7) Not all spend is additive.

An increasing share of organizations fund AI by trimming elsewhere; legacy IT and some outsourced services are common sources. This is a healthy signal: AI budgets are being earned through trade-offs, rather than being added on top. Reallocation also nudges teams to retire older processes and modernize stacks that can support AI-enabled workflows.

8) The most reliable value sits in everyday use cases.

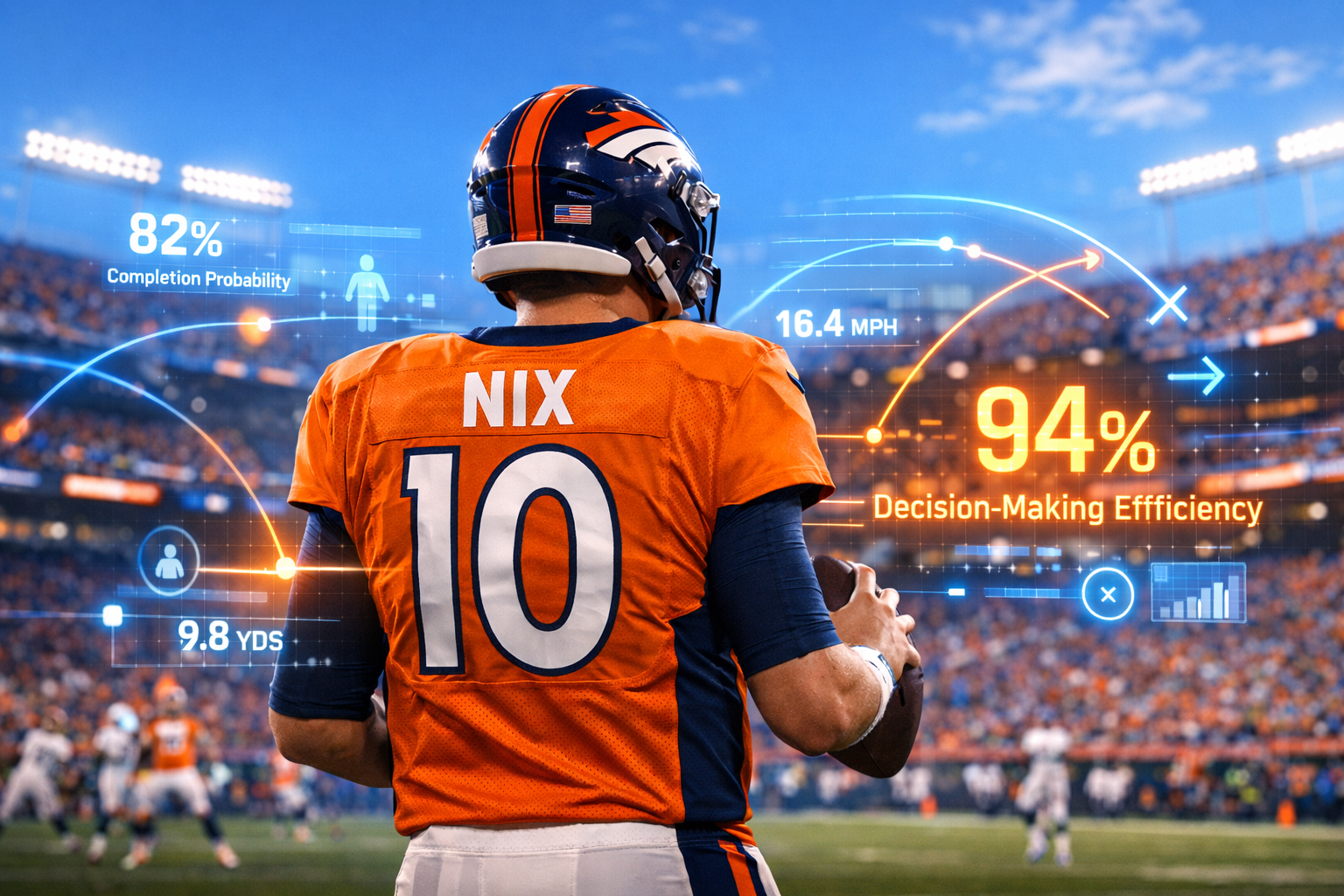

The winners are the repeatable, high-frequency activities where AI shortens cycles and improves consistency: data analysis, meeting and document summarization, document and presentation creation, editing, and email generation. A notable 2025 shift is the alignment between “most used” and “best performing,” indicating that organizations have learned where the tech is reliably good and have standardized around it. That's how productivity gains become durable rather than episodic.

9) Agents are emerging, with efficiency first, autonomy later.

Fifty-eight percent report some use of AI agents, but these systems are mainly human-supervised and aimed at throughput: process automation, cross-team coordination, analytics, and monitored operations such as ticket triage, DevOps, or finance operations. The emphasis is on removing handoffs and time sinks, while keeping human judgment in the loop. Expect to see assistants that do real work to scale before fully autonomous agents.

10) Adoption leadership has moved upstairs.

IT remains central, but executive leadership’s direct role jumped 16 points to 67%, which puts accountability for outcomes in the C-suite. That shift tracks with budget size and the need to align risk, procurement, and measurement. As programs mature, ad hoc enthusiasm gives way to formal ownership and cross-functional operating models.

11) Chief AI Officers are now mainstream.

About 60% of enterprises report a CAIO or equivalent. However, note that in many cases it is an added remit for an existing executive rather than a brand-new headcount. Ultimately, job titles matter less than formalizing governance, measurement, and stack integration. To that point, someone has to own the intake process, the guardrails, and the proof that the program is working.

12) Guardrails and training are maturing – and calibrated by function.

Data-security policies (64%) and employee training and awareness (61%) ticked up year over year. Approvals and restrictions are tightening where risk is concentrated (often in IT or sensitive-data areas) and easing for routine work as norms become clearer. The net effect is smoother everyday use with fewer bottlenecks and better coverage where it matters.

13) Skills are improving, but watch for “proficiency decline.”

Eighty-nine percent of respondents say AI enhances skills, yet 43% worry heavy reliance can dull certain proficiencies over time – especially for newer employees. The suggested fix: Rather than slowing adoption, design proficiency into the mix. In other words, alternate AI-assisted work with periodic "AI-off" projects, and evaluate judgment and reasoning in addition to speed. That is how companies can keep human capability strong while the tools scale.

14) Tool choices favor employer-paid plans that fit existing clouds.

OpenAI's ChatGPT, Microsoft Copilot, and Google Gemini all gained usage year over year. Most chatbot subscriptions are employer-funded; beyond ChatGPT, paid choices tend to mirror the company’s primary cloud provider for smoother integration, identity, and security. Buying criteria have shifted from novelty to fit, performance, and governance.

15) Industry momentum is uneven, though gaps may narrow.

Tech and Telecom lead on daily use and confidence in transformational impact; Retail and Manufacturing trail, often because of complex physical operations and legacy stacks. Even so, Retail shows one of the sharpest jumps in leaders calling themselves “expert” or “very knowledgeable,” which hints at faster progress ahead. Sector differences affect pacing, not direction.

16) Decision-maker perception differs by level.

Senior leaders (VP and above) are likelier to report “significantly positive” ROI, while mid-managers more often say it is early or still in pilots. That gap reflects visibility: Executives see aggregate productivity and margin data, while managers feel friction in day-to-day change. Bridging the stories – linking top-line benefits to team-level proofs – can help to sustain the momentum.

17) Mid-market firms are especially bullish on the near term.

Tier 2 and Tier 3 companies (roughly $50 million to $2 billion in annual revenue) show the strongest confidence in returns over the next two to three years. These organizations – frequently a small fraction of the size of Tier 1 firms – can integrate faster, face fewer legacy constraints, and can standardize around a focused set of use cases. The result is earlier payoffs, even with smaller absolute budgets.

18) Function adoption patterns are clarifying.

IT, HR, and Finance tend to apply AI across a broader set of tasks, while Product and Engineering, Marketing and Sales, and Legal concentrate on fewer core use cases. This maps to where work is repeatable and data is structured – exactly where AI can be codified into standard operating procedures. Over time, expect narrow-and-deep functions to broaden as agent patterns mature.

19) Rebalancing budgets signals organizational reshaping.

As AI lines grow, some legacy systems and external services shrink. Beyond funding new tools, the shift changes how work is done, pulling capability inside and aligning it with company data and security. The more aligned the stack, the easier it becomes to scale gains across teams.

20) People and policy are the enduring choke points – and the lever for progress.

Top challenges include recruiting advanced GenAI skills, delivering effective training, maintaining morale through change, and building change-management capacity. Policy coverage continues to broaden (data privacy, ethical use, human oversight), and many organizations now apply AI to risk management itself. The technology is moving quickly, but outcomes still turn on how teams are prepared and how the work is governed.

Summary

The report’s bottom line is practical rather than celebratory. Use has broadened, budgets are still growing, and many organizations report positive returns, but much of the near-term value comes from repeatable office workflows and from tighter integration with existing cloud stacks. Reallocation away from legacy systems is part of the story, signaling a shift in how technology portfolios are managed.

Execution remains uneven and depends heavily on people and process. Leaders cite recruiting advanced skills, designing effective training, and managing change as ongoing constraints. Governance is maturing – especially around data security and oversight – with policies tightening where risk is concentrated and easing where routine work needs fewer approvals.

In the big picture, the outlook is cautiously optimistic. Decision-makers generally expect AI payoffs on a two- to three-year horizon, while noting differences by industry and company size. The record in this report points to a pragmatic formula for the next phase: Choose the work that repeats, fit tools to the tech stack you already run, and measure outcomes as you roll them out.

In the weeks ahead, Colorado AI News will examine additional findings of Wharton's 2025 "Accountable Acceleration" AI Adoption Report.